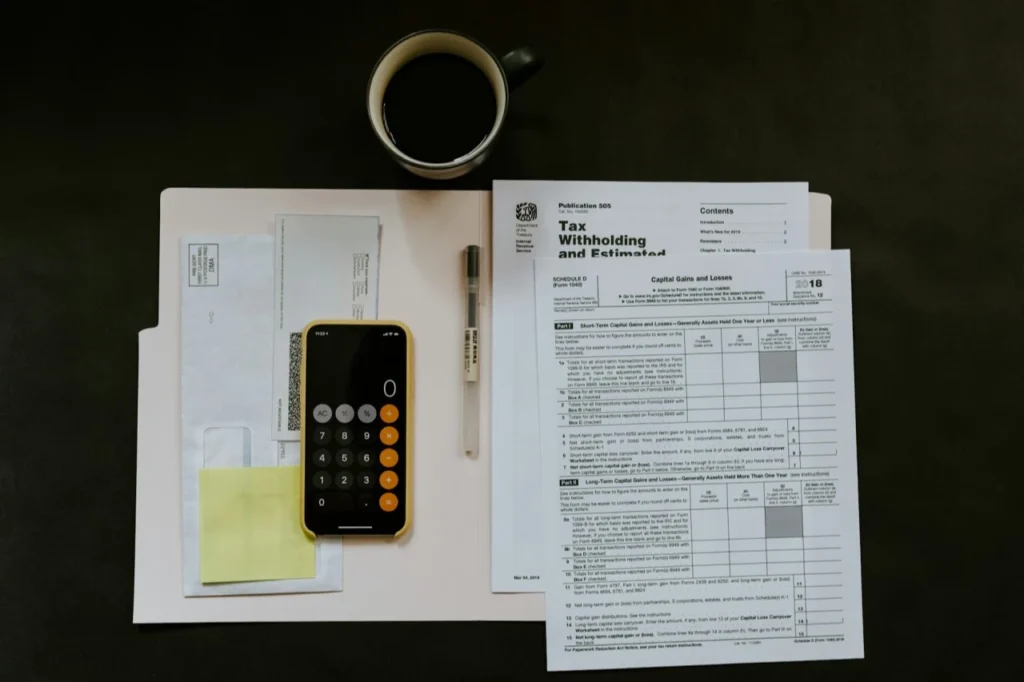

Accounts payable outsourcing finds application across diverse industries, including retail, manufacturing, healthcare, hospitality, financial services, and utilities. Regardless of sector, the benefits of outsourcing translate into enhanced operational efficiency and financial performance.

Accounts payable outsourcing represents a strategic opportunity for organizations to optimize financial processes, drive efficiency, and enhance competitiveness. By carefully selecting partners, implementing best practices, and mitigating associated risks, businesses can unlock the full potential of outsourcing while positioning themselves for sustained success in today’s dynamic business landscape.

Please feel free to contact us for any inquiries or to discuss your outsourcing needs.

Copyright @ 2024 by Pumraw Consultancy

Web Design by Pumraw Consultancy